Apple's high-yield savings account is a no-brainer for Apple Card users

Apple's savings account requires no minimum balance or minimum deposits, offering a 4.15% APY.

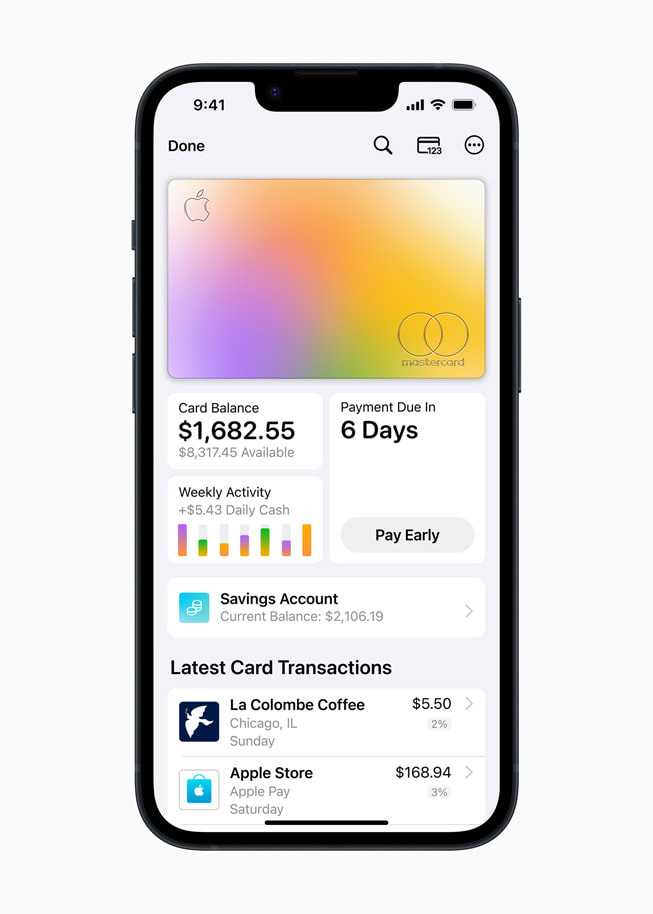

Apple Card has been a top option for customers looking for a simplified credit card experience, and the company is bringing that same ease-of-use to a savings account. Both financial features are backed by Goldman Sachs, the eighth-largest bank in the U.S. according to Bankrate.

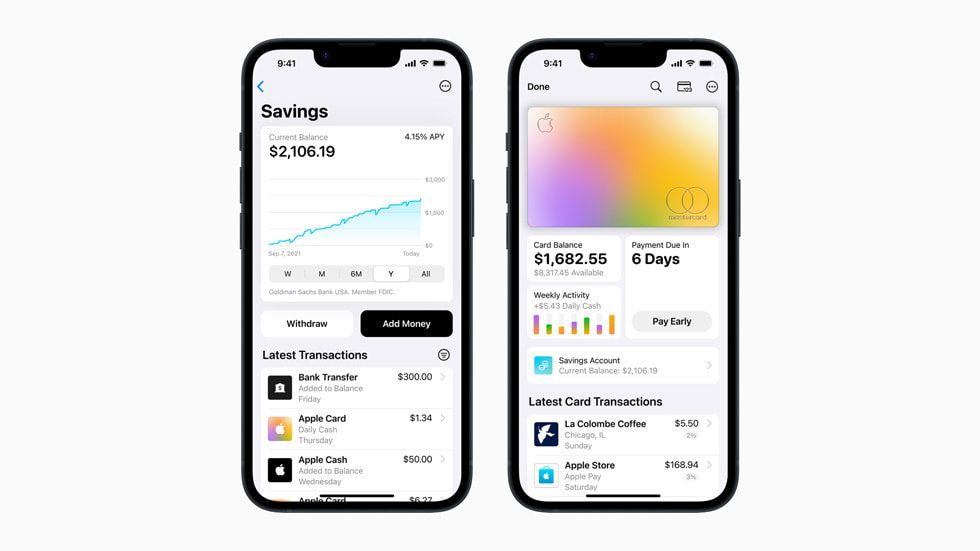

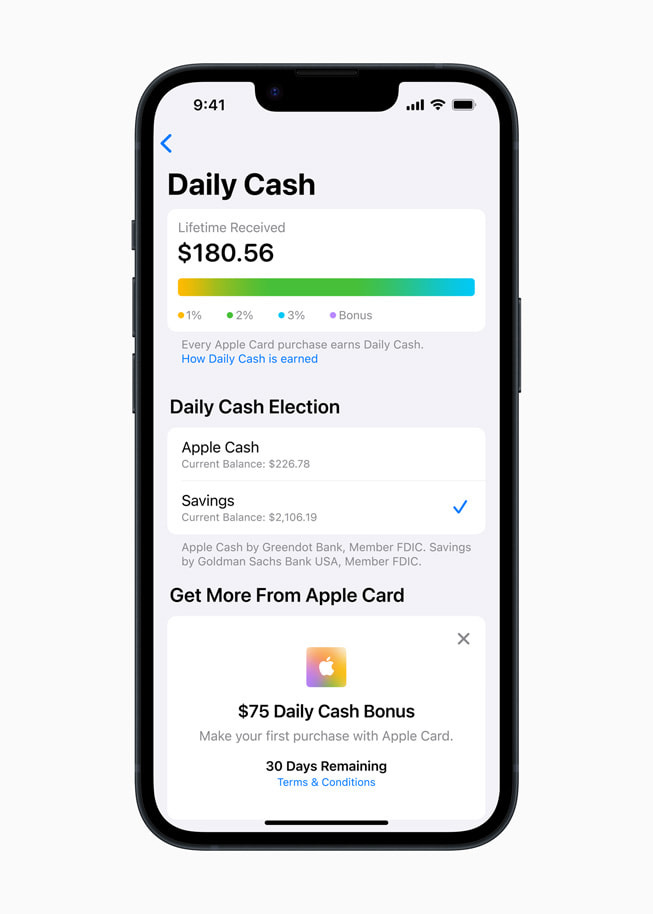

The savings account is only available to Apple Card users, and is designed to be used with the Daily Cash benefits earned by making purchases with the credit card. Users earn 2% cashback on every purchase made with the Apple Card via Apple Pay and 1% cashback by using the physical titanium credit card. Some retailers offer enhanced 3% cashback rates, like Apple and Nike.

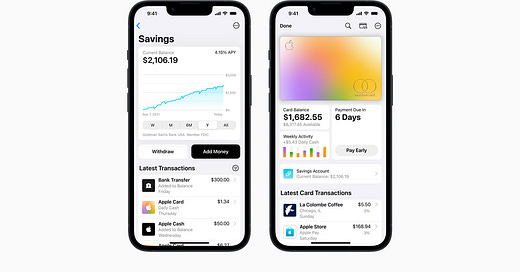

Typically, this Daily Cash is deposited into a user’s Apple Cash card at the end of each day, which lives in the Apple Wallet. But once you sign up for Apple Card Savings, your Daily Cash will be automatically deposited into the high-yield savings account that garners 4.15% return year-over-year.

Apple Card Savings quite literally earns you free money

Though it’s great to be able to buy yourself a coffee or lunch with Daily Cash, putting that money in the Goldman Sachs savings account is a no-brainer. I’ve had the Apple Card for a year, spending about $1,000 per month on the card, and earned $380 in Daily Cash during that time.

If that money was deposited in an Apple Card Savings account, I’d have roughly $15 more due to the interest accrued. Since the savings account compounds each day, the actual figure would be a bit more than that. Of course, earnings increase with spending and Daily Cash rewards, so you could earn more each year.

There’s also a case to be made for Apple’s savings account to become your primary savings account, which provides a greater value proposition. A standard savings account from Wells Fargo (the fourth-largest bank in the U.S.) comes with a measly 0.15% annual return — four percent less than Apple Card Savings. You can search for other high-yield savings accounts with comparable annual returns elsewhere, but they typically come with fees, monthly minimum balances and a more complicated experience.

No fees, just cash

Since Apple Card Savings is only available to Apple Card users, people might be wary of getting the Apple Card for the account. But like there are no fees, minimum deposits or minimum balances required to use the Apple Card Savings account, there aren’t any fees with Apple Card either.

Users have to pay interest if they don’t pay off their balance each month (varying from 15.74% to 26.74% APR), but there aren’t any late fees, foreign transaction fees or over-the-limit fees. There’s no “catch” with Apple Card and Apple Card Savings — they’re just great credit card and savings account options for people who frequently use Apple Pay and are in the market for a high-yield savings account.

Open an account in as little as a few minutes

Part of the appeal of Apple Card is its ease of use, and Apple Card Savings is no different. Opening an Apple Card Savings account takes just a few minutes and requires only a few steps.

After updating to the latest version of iOS (Apple Card Savings requires iOS 16.4 or newer), start by opening the Apple Wallet app on iPhone. Then, select your Apple Card in the wallet. Tap the three dots in the top right corner of your screen and tap Daily Cash. Finally, tap the Set Up text beside Savings, and follow the on-screen prompts to continue.

Remember, you are opening a bank account, so you’ll need your social security number handy and will have to read and sign an agreement. To get started, you can either deposit your Daily Cash from an Apple Cash card to the savings account or transfer money from a connected bank account.

A high-yield savings account with this much flexibility is nearly unprecedented in the banking industry, so interested customers should jump on this offer and start earning interest now.